california renters credit turbotax

The credit will offset the taxes paid to the other state so you are not paying taxes twice. The program will determine the amount of credit based on the tax return information.

How Do I Switch From E Filing To File By Mail Turbotax Support Video Youtube

The rebate can be up to 250 125 if married filing separately and can be claimed when you file your state tax return.

. The States that offers renters credit are as. You may claim this credit if you had income that was taxed by California and another state. You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria.

You paid rent in California for at least 12 the year. To claim the CA renters credit. The rent is paid my dad but my brother and me give him money.

By Intuit 105Updated July 12 2022. 43533 or less if your filing status is single or marriedregistered. Millionaire taxes would increase 11 in 2023 under House Democrat plan.

Single filers who fall under the. Your California income was. Lacerte will determine the amount of credit.

I dont see anything from the IRS saying there is a limit on how. Tax credits help reduce the amount of tax you may owe. Depending upon the CA main form used the output will appear on ine 46 of the.

If your State asks rent related questions while answering the TurboTax State interview questions it will cover that deduction. Go to Screen 53 Other Credits and select California Other Credits. If you pay rent for your housing have a family with children or help provide money for low-income college students you may be.

For example if you live in California you may qualify for a renters credit if you pay rent for your housing your income is below a certain amount and you meet other state. New York NY offers a credit to renters who fulfill. Renters in California may qualify for up to 120 in tax credits.

House Democrats proposed tax reforms would raise levies for 1 million households by about 11 on average in. Entering Form 8846 credit information makes the balance sheet. I have proof of this through the checks written out to my dad.

Entering a repayment of First-Time Homebuyer Credit on Form 5405. The 2019 earnings limits are 42932 single and 85864 married. Renter CreditIncrease Credit Beginning January 1 2019 Author.

Check the box Qualified renter. The property was not tax exempt. Renter CreditIncrease Credit Beginning January 1 2019 Keywords.

You were a resident of California for at least 6 full months during 2021.

Irs Form 540 California Resident Income Tax Return

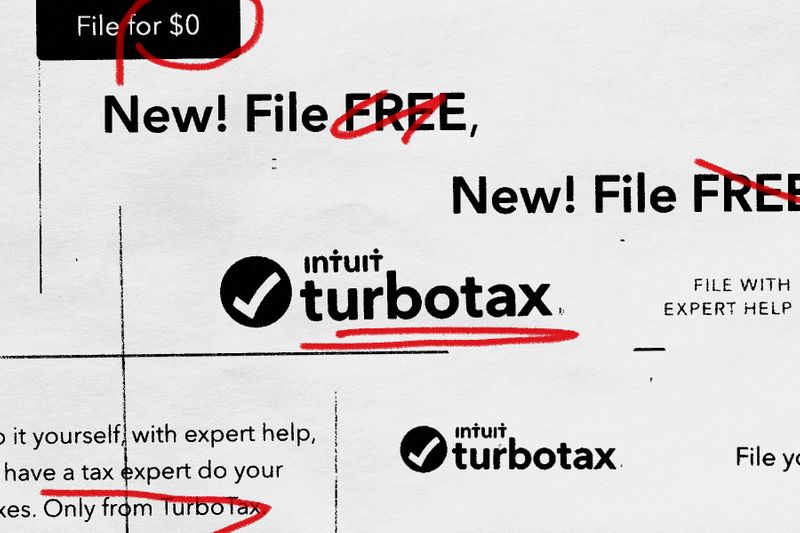

Intuit Will Pay Millions To Customers Tricked Into Paying For Turbotax Propublica

Turbotax Customers Can Now Use The New Credit Karma Checking Account

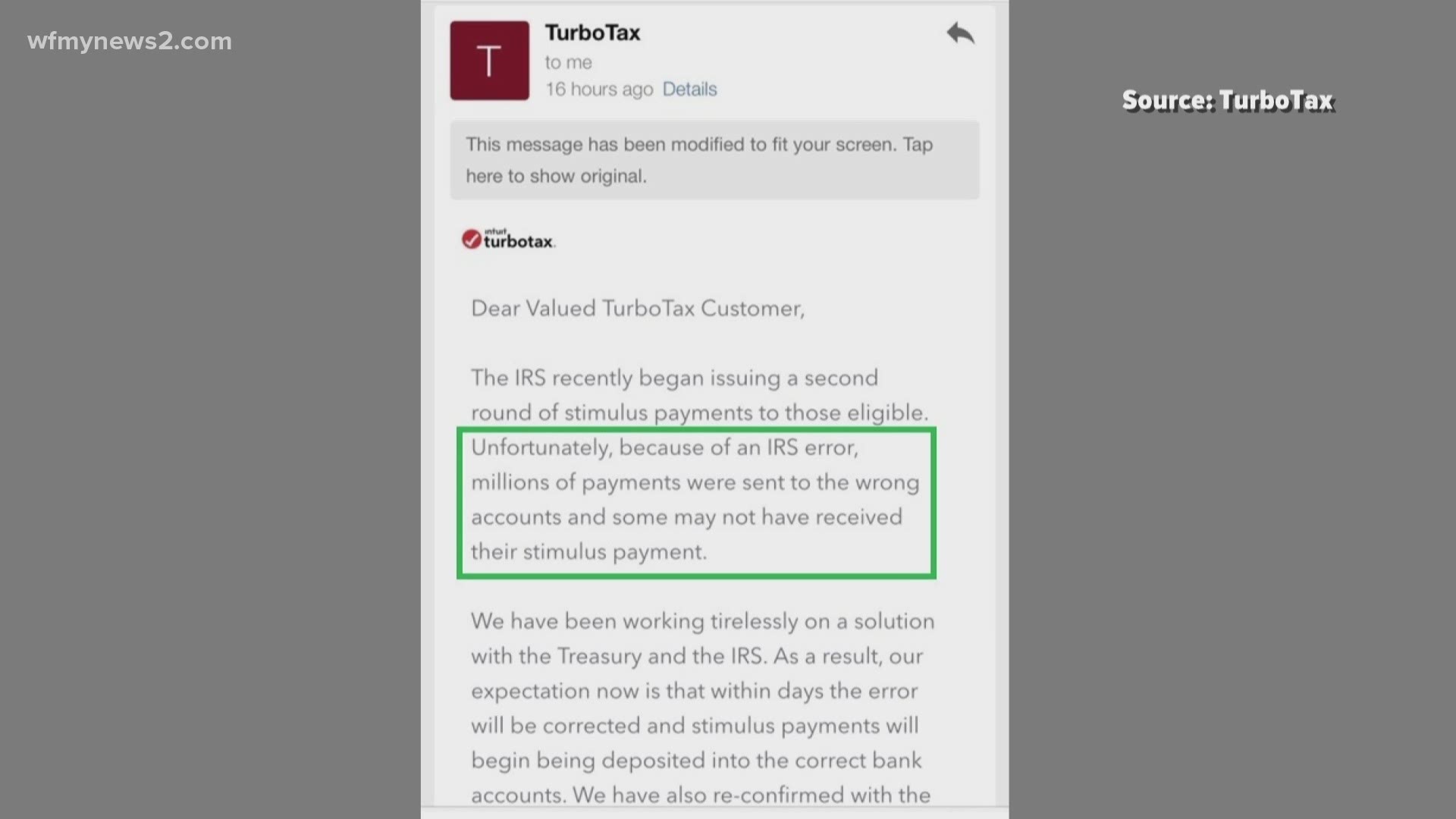

How To Get Your Missed Stimulus Payments Nextadvisor With Time

Turbo Tax And H R Block Customer Waiting On Stimulus Payment Wfmynews2 Com

What Is The Savers Credit Turbotax Tax Tips Videos

How To File Taxes For Free Turbotax 2022 Free File Change Money

5 Ways California Tax Filers Leave Money On The Table Kpcc Npr News For Southern California 89 3 Fm

Turbotax Premier Online 2021 2022 File Investments Cryptocurrency Rental Property Taxes

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Turbotax Review 2022 Pros And Cons

Intuit Will Refund 141 Million To Low Income Turbotax Users The New York Times

How To File Taxes For Free In 2022 Money

Your Top Tax Questions About Coronavirus Covid 19 Answered The Turbotax Blog

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Turbotax Owner S Acquisition Of Credit Karma Could Spark Antitrust Concerns Bloomberg

Turbotax Maker Intuit Faces Tens Of Millions In Fees In A Groundbreaking Legal Battle Over Consumer Fraud Propublica